Governance

Corporate Governance

NBF’s Governance

NBF’s Articles of Incorporation stipulate that NBF shall have at least one Executive Director and no more than four Supervisory Directors (but the number must be at least one more than the number of Executive Directors). At present, NBF’s organization consists of a General Meeting of Unitholders and a Board of Directors, along with an Accounting Auditor.

NBF’s Board of Directors is comprised of one Executive Director and three Supervisory Directors. NBF specifies in the Rules of Board of Directors that the Board of Directors must meet at least once every three months, and it gathers at a frequency of approximately once a month.

For the composition of the Board’s members, please click here.

(1) Board of Directors

In addition to the matters for approval stipulated by law, NBF’s Board of Directors reports on NBF’s management and the execution of operations at the asset management company Nippon Building Fund Management, Ltd. (NBFM). Via this reporting procedure, it maintains a structure that enables the Supervisory Directors, who are independent of NBFM and its stakeholders, to obtain accurate information and oversee the Executive Director’s performance.

The Board of Directors possesses the authority to convene General Meetings of Unitholders and approve the execution of certain duties stipulated in the Act on Investment Trusts and Investment Corporations (the “Investment Trusts Act”) as well as other powers stipulated in the Act and the Articles of Incorporation and the authority to oversee the Executive Director’s performance. Except where specified otherwise in the law or Articles of Incorporation, resolutions of the Board of Directors shall be attended by a majority of the members with the right to vote and passed based on a majority vote of those present.

(2) Executive Director

The Executive Director executes the operations of NBF and has the authority to act in or out of court on its behalf in any matters relating to its operations.

(3) Supervisory Directors

External professionals with specialized expertise, such as lawyers, real estate appraisers, or certified public accountants, shall be appointed as Supervisory Directors, each of whom shall fulfill supervisory functions relating to the Executive Director’s execution of duties from their respective specialized viewpoints.

At Board of Directors meetings, the Supervisory Directors shall request reports on asset management status, compliance, and risk management from the Executive Director and NBFM. They also carry out oversight of the Executive Director’s execution of duties through conducting investigations as needed.

NBF’s Supervisory Directors are “independent Directors” in alignment with the standards for independence from the Executive Director, asset management company, etc. stipulated in the Investment Trusts Act, and the current Board of Directors is comprised of individuals with no special interest in NBF, including the chairperson.

(4) Accounting Auditor

The Accounting Auditor audits NBF’s financial statements and other documents and is responsible for reporting improper conduct by the Executive Director, a material breach of the law, or the like to the Supervisory Directors in the event that such an incident is discovered. The Accounting Auditor shall provide an audit report to the Supervisory Directors ahead of the meeting of the Board of Directors for approving financial statements and work in collaboration with the Supervisory Directors by conducting interviews regarding awareness of fraud, suspicion of fraud, or an allegation of fraud that would impact NBF.

(5) Monitoring of Internal Control Status, Etc.

NBF monitors the status of internal control at NBFM by receiving reports at its Board of Directors meetings about the results of internal audits conducted by NBFM, the details of Risk Management Committee meetings held once every three months, and other matters.

Furthermore, with regards to other related companies to which tasks are outsourced, it has established a system for managing the execution of operations by conducting interviews about these companies’ internal management, internal control status, and the like via NBFM as needed.

NBF’s Executive Director and Supervisory Directors

When selecting Director candidates, the Board of Directors makes decisions based on their expertise, qualifications, and eligibility, assuming that they do not meet any of the reasons for disqualification stipulated in various laws such as the Investment Trusts Act, and chosen candidates are appointed via a resolution of the General Meeting of Unitholders held on a biennial basis, per NBF’s Articles of Incorporation.

| Title | Name | Reasons for Election | Attendance at Board of Directors Meetings (2024) |

|---|---|---|---|

| Executive Director | Koichi Nishiyama (Male) | Mr. Nishiyama was elected after being deemed suitable for the position of Executive Director and with the expectation that he would be able to execute business from a broad perspective based on his knowledge in the real estate financing business and experience, etc. as NBFM’s President & CEO. | 100% (12/12 meetings) * This shows the attendance of Koichi Nishiyama, who resigned effective March 13, 2025. |

| Supervisory Director | Masaki Okada (Male) | Mr. Okada was elected after being deemed suitable for the position of Supervisory Director and with the expectation that he would be able to oversee the Executive Director’s execution of duties objectively from a broad perspective based on his knowledge and experience, etc. as an expert of law. | 100% (12/12 meetings) |

| Supervisory Director | Keiko Hayashi (Female) | Ms. Hayashi was elected after being deemed suitable for the position of Supervisory Director and with the expectation that she would be able to oversee the Executive Director’s execution of duties objectively from a broad perspective based on her knowledge and experience, etc. as an expert of accounting and tax. | 100% (12/12 meetings) |

| Supervisory Director | Kazuhisa Kobayashi (Male) | Mr. Kobayashi was elected after being deemed suitable for the position of Supervisory Director and with the expectation that he would be able to oversee the Executive Director’s execution of duties objectively from a broad perspective based on his knowledge and experience, etc. as an expert of real estate. | 100% (12/12 meetings) |

Status of Directors

| Title | Name | Chairperson | Independent Director (Note 2) |

Expertise and Experience | Qualification | No. of Investment Units Owned | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Corporate Management | Treasury, Accounting and Finance | Compliance and Risk Management | Real Estate | ESG and Sustainability | ||||||

| Executive Director | Kenji Iino | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 122 units | ||

| Supervisory Director | Masaki Okada | 〇 | 〇 | 〇 | 〇 | Lawyer | 0 units | |||

| Supervisory Director | Keiko Hayashi | 〇 | 〇 | 〇 | 〇 | Certified Public Accountant | 0 units | |||

| Supervisory Director | Kazuhisa Kobayashi | 〇 | 〇 | 〇 | 〇 | Real Estate Appraiser | 0 units | |||

- The above table indicates the typical skills of each director and does not show all of their knowledge and experiences.

- “Independent Director” in the table refers to “independent directors” in alignment with the standards for independence from the Executive Director, asset management company, etc. stipulated in the Investment Trusts Act.

Please see the link below for the career summary of each director.

Career Summaries of NBF’s Directors

Investment Unit Ownership Policy

In order to prevent insider trading, NBF has stipulated Insider Trading Control Rules, which prohibit the purchase and sale of its investment units and investment corporation bonds by directors.

Evaluation of the Effectiveness of NBF’s Board of Directors

NBF analyzes and evaluates the effectiveness of the Board of Directors, aiming to further enhance its functions. It evaluates the effectiveness by conducting a questionnaire survey to be answered by each member of the Board of Directors once a year, and NBFM compiles and reports the results to the Board of Directors. In the evaluation conducted in December 2024, the results were generally high, confirming that the effectiveness of NBF’s Board of Directors was secured. Based on this evaluation, we will continue to make efforts to further improve the effectiveness of the Board of Directors.

Compensation of Directors

Compensation of Directors

Compensation for each of NBF’s Directors is no more than 700,000 yen per month per person. The amount is determined by the Board of Directors based on the amount that is deemed reasonable in light of compensation standards for Directors and auditors who perform comparable duties, general price trends, wage trends, and so forth.

| Title | Name | Total Amount of Compensation (2024) |

|---|---|---|

| Executive Director | Koichi Nishiyama | 7,200,000 yen * This shows the amount of Koichi Nishiyama, who resigned effective March 13, 2025. |

| Supervisory Director | Masaki Okada | 6,000,000 yen |

| Supervisory Director | Keiko Hayashi | 6,000,000 yen |

| Supervisory Director | Kazuhisa Kobayashi | 6,000,000 yen |

The Directors receive fixed compensation only. There is no variable compensation.

Compensation of Accounting Auditor

The auditing compensation for the Accounting Auditor is as shown below.

| Name | Description of Fees | Total Compensation (2024) |

|---|---|---|

| KPMG AZSA LLC | Audit-based fees | 30,000,000 yen |

| Non-audit-based fees | 0 yen |

In accordance with auditing firm regulations based on the Certified Public Accountants Act, this shall be managed as follows:

- Executive officers may not be involved in the company’s auditing tasks for more than seven accounting periods, and the chief executive officer may not be involved in them for more than five accounting periods.

- Executive members may not be involved in the company’s auditing tasks for more than five accounting periods after replacement, and the chief executive officer may not be involved in them again after replacement.

NBF’s Management Structure

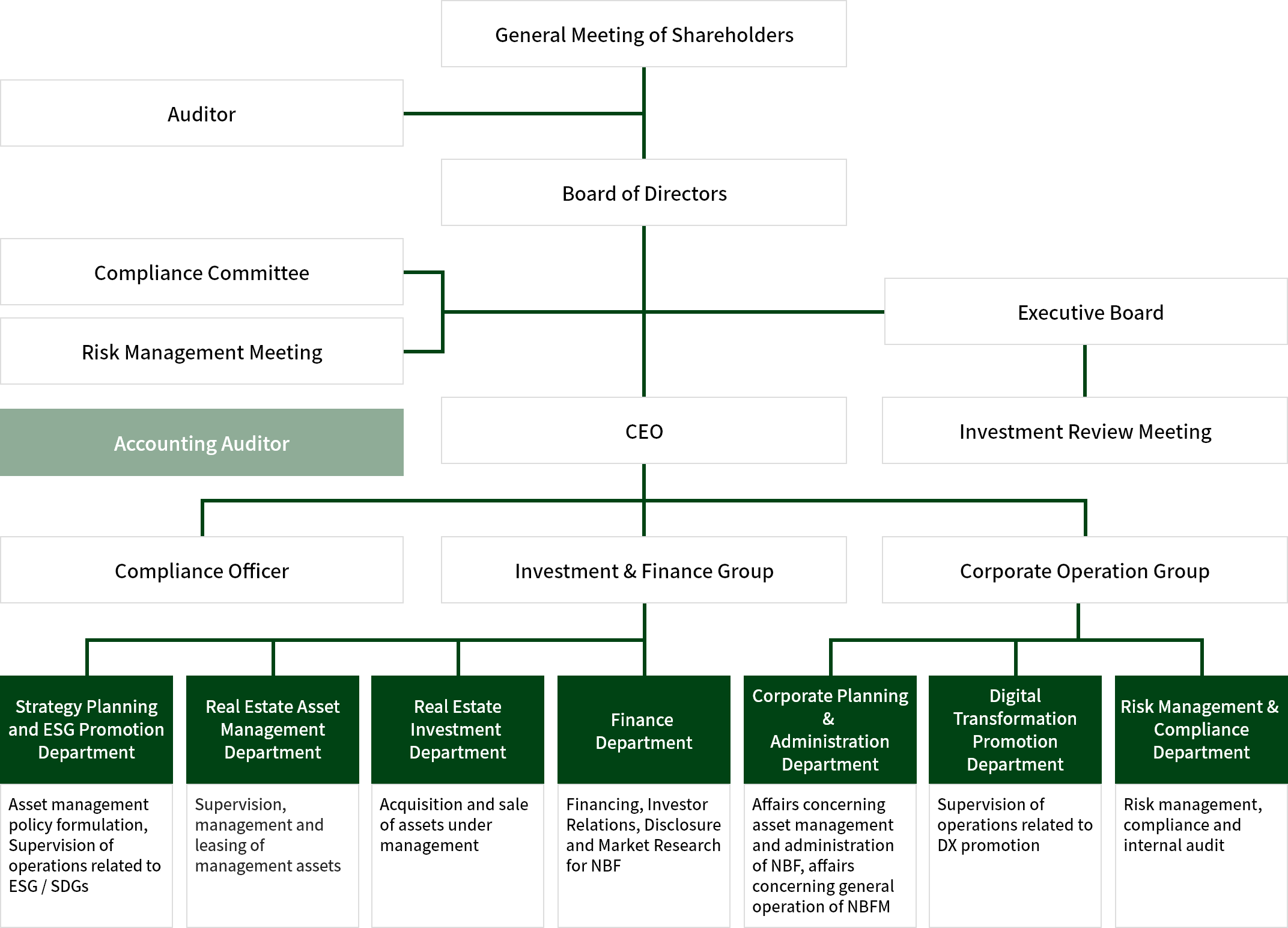

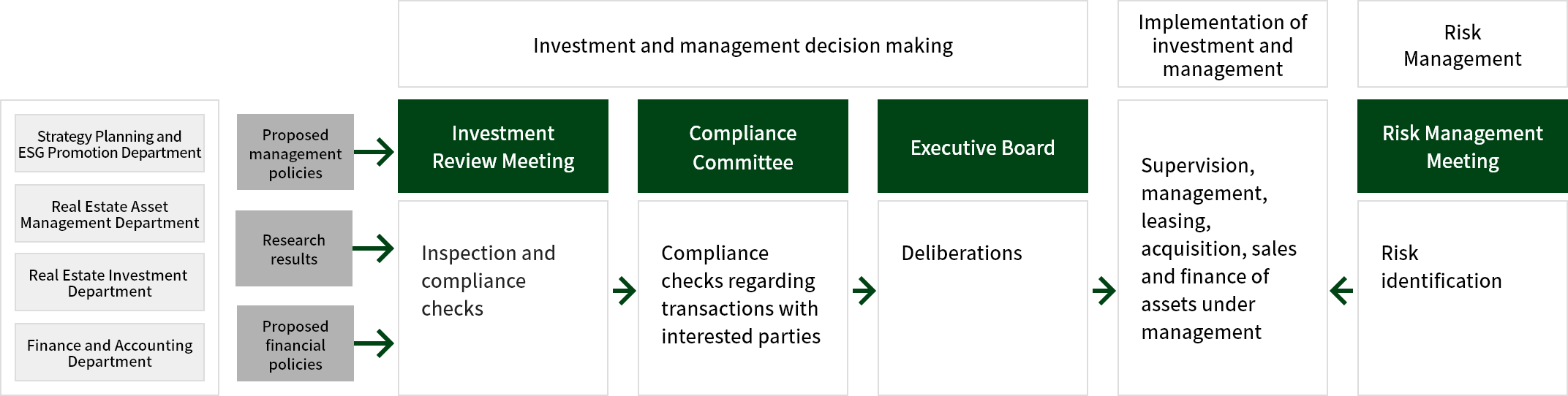

NBF entrusts its asset management to the asset management company Nippon Building Fund Management, Ltd. (NBFM). NBFM handles tasks based on the management structure shown in the image below, in accordance with the Asset Management Entrustment Agreement with NBF.

NBFM’s organizational chart is as follows.

Overview of Each Body

| Name of Body | Members | Meeting Frequency | Overview |

|---|---|---|---|

| Executive Board |

CEO Head of Investment & Finance Group (Director, CIO and CFO) Head of Corporate Operation Group (Director, and COO) |

As a rule, meets when discussion is required |

Discusses general policies for executing operations, planning, and executing important tasks, verifies compliance, and considers the merits of submitting issues to persons with decision-making authority. |

| Compliance Committee |

CEO Head of Investment & Finance Group Head of Corporate Operation Group Compliance Officer External members |

As a rule, meets at least once per 3 months |

Verifies compliance for material compliance-related matters, such as transactions with interested parties. |

| Risk Management Meeting |

CEO Head of Investment & Finance Group Head of Corporate Operation Group Compliance Officer Department Managers Risk Management & Compliance Department |

As a rule, meets at least once per 3 months |

|

| Investment Review Meeting |

CEO Head of Investment & Finance Group Head of Corporate Operation Group Compliance Officer and Department Managers |

As a rule, meets at least once per month |

The Investment Review Meeting body formulates and approves specified key management strategies, policies, etc., conducts practical discussions about individual projects, and so forth (including verification of compliance), with the aim of improving management efficiency through appropriate management and striving to protect assets under management when carrying out management of the assets entrusted by NBF. |

Initiatives Relating to Conflicts of Interest

Basic Policy Regarding Potential Conflict-of-Interest Transactions

With regard to transactions conducted in relation to asset management that involve a potential conflict between the interests of NBF and the interests of NBFM or its interested parties, NBFM is always aware of its duty to explain transactions to NBF and its unitholders and actively prevents transactions that are not fair and equitable in accordance with the law and internal regulations.

Appropriate Management of Potential Conflict-of-Interest Transactions

Based on the Rules on Transactions with Interested Parties, NBFM has defined the scope of interested parties to be managed more broadly than it is defined by law, stipulated decision-making procedures for transactions with interested parties, the scope of applicable transactions, and transaction standards, based on which it implements appropriate management of potential conflict-of-interest transactions.

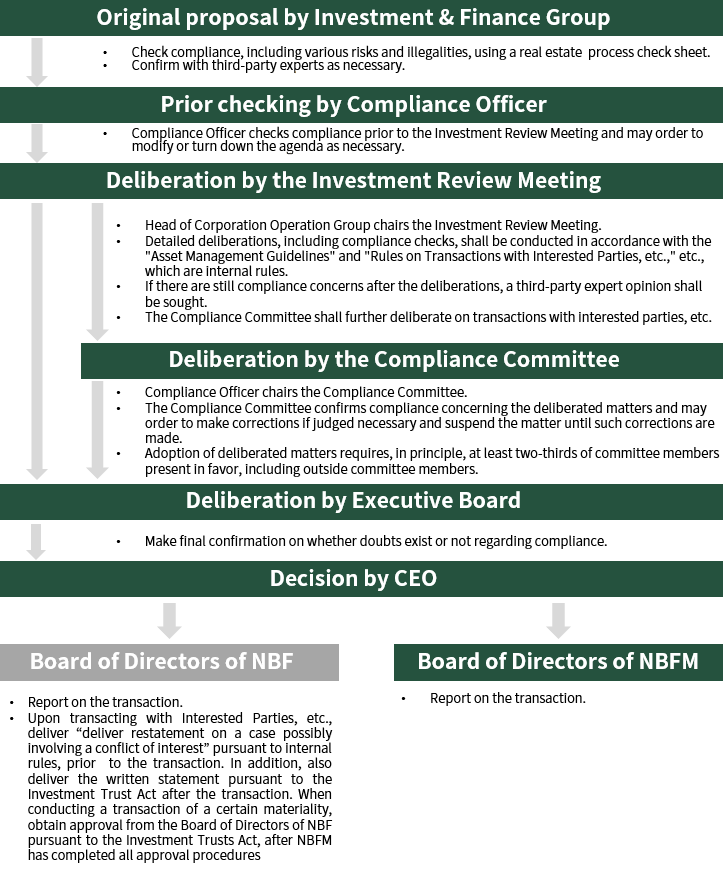

Asset Management Decision-Making and Internal Control Structure for Potential Conflict-of-Interest Transactions