Governance

Compliance

Basic Policy

Officers and employees of NBF and NBFM comply with laws and regulations and maintain high ethical standards and conduct business activities in an honest and appropriate manner.

In its Rules of Board of Directors, NBF specifies that the Board of Directors must meet at least once every three months, and it gathers at a frequency of approximately once a month, receiving reports from the Executive Director about the execution of operations and ensuring oversight and check functions through the Supervisory Directors. The Board of Directors has a structure with three Supervisory Directors for one Executive Director, and external professionals with specialized expertise, such as lawyers, real estate appraisers, or certified public accountants, are appointed as the Supervisory Directors.

In accordance with the Management Policies that stipulates its basic management philosophy, NBFM positions compliance as a key issue in management with the aim of increasing the confidence of all investors and other stakeholders. Moreover, as an asset management company entrusted with managing assets, it strives to appropriately manage the assets under management by specifically stipulating norms, processes, strategies, etc. that should be complied with and fulfills its fiduciary responsibilities.

Viewing compliance as a category that includes not only legal compliance but also following internal regulations and acting in accordance with general social ethics and norms, NBFM has established internal regulations such as its Code of Ethics and Compliance Rules as practical guidelines and rules. Furthermore, its Compliance Officer promotes company-wide compliance activities by planning a Compliance Program, training and awareness activities for officers and employees.

In the event of concerns arising about a violation of or conflict with the laws, regulations, or internal rules, the Compliance Rules stipulate that officers and employees of NBFM must immediately report the relevant facts, the background to the incident’s occurrence, and the approach to its resolution to the Compliance Officer. If it is deemed that there is a problem relating to the reported information, the Compliance Officer must promptly report it to the CEO, the head of the Investment & Finance Group, and the head of the Corporate Operation Group and discuss the appropriate response. Furthermore, if necessary, the Compliance Officer will obtain confirmation from external experts and report to the Compliance Committee, Board of Directors, and NBF Board of Directors as well.

In light of the laws, regulations, and internal rules, if a compliance violation occurred or if it is deemed that there is conduct that could cause a violation, the necessary measures will be taken following discussion by the Board of Directors in the case of an officer, while employees will be subject to discipline based on its work rules.

(From January to December 2024, there were no claims violation cases, or disciplinary actions for officers or employees relating to compliance breaches.)

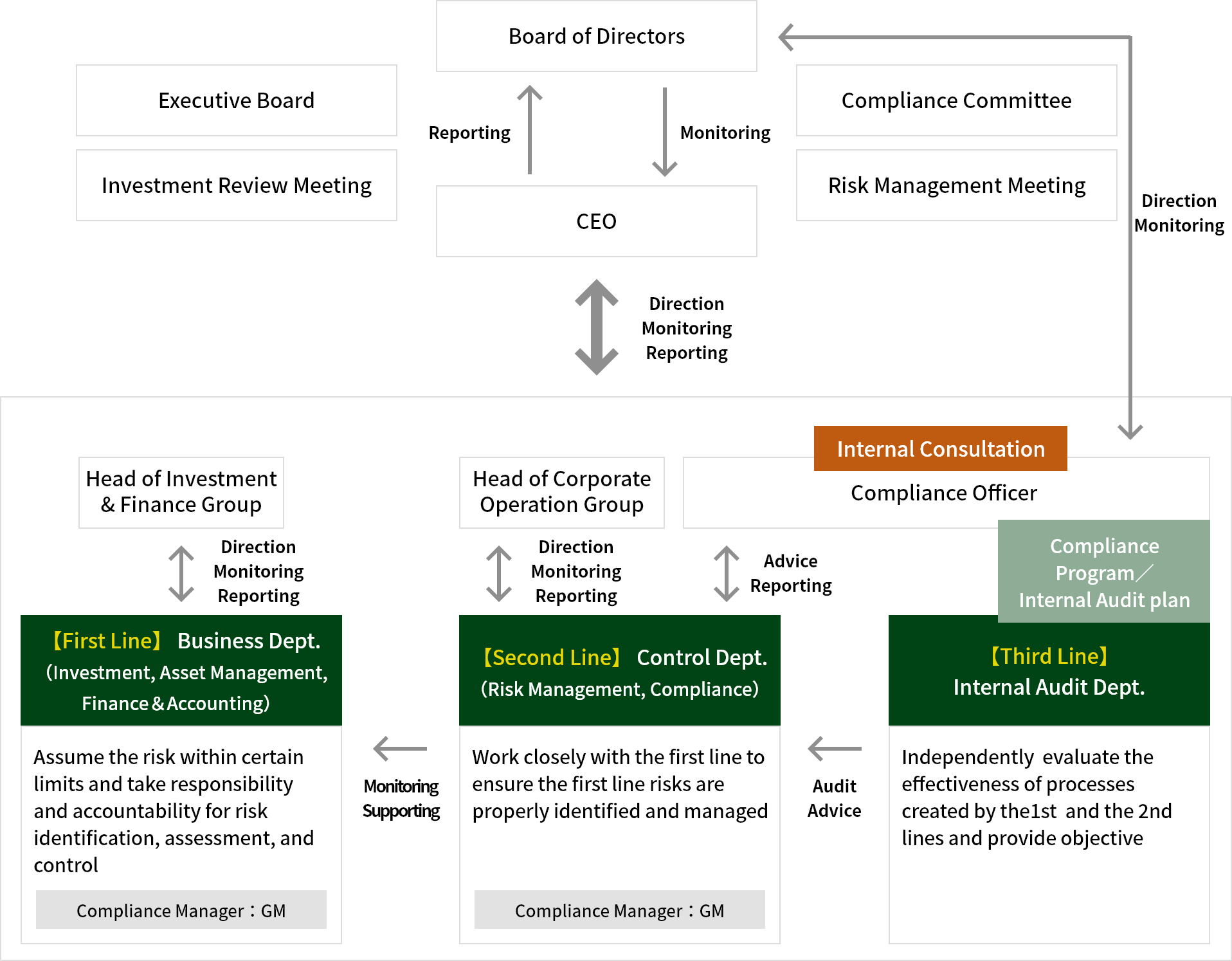

Compliance Promotion Structure

NBFM has established the following compliance promotion structure, and in its decision-making process, compliance-related verification is implemented based on a multi-level review structure.

| Body/Title | Main Role |

|---|---|

| Board of Directors | The Board of Directors determines basic management policy and is responsible for ensuring that compliance is implemented fairly and effectively as a supervisory body for the Directors. The Board of Directors discusses the formulation, revision, and abolition of the Compliance Rules, Compliance Committee Rules, Compliance Manual, etc. in addition to discussing the formulation of the Compliance Program, which serves as a practical plan relating to compliance implementation for each department and receives reports on its progress status. |

| Board of Auditors | As an independent body, the Board of Auditors is responsible for establishing a high-quality corporate governance structure that will meet social expectations and accommodate the sound continued growth of the company by auditing the Directors’ execution of their duties. For this purpose, the Board of Auditors attends meetings of the Board of Directors and Compliance Committee in an advisory capacity and expresses its opinions as necessary. Furthermore, it reviews important approved documents and other important documents related to the execution of operations, requests explanations from Directors or employees if necessary and expresses opinions about them. |

| Compliance Committee | Comprised of the CEO, head of the Investment & Finance Group, head of the Corporate Operation Group, and Compliance Officer along with external members appointed by the Board of Directors, this committee discusses key matters relating to compliance, such as certain transactions with interested parties, receives reports, and conducts compliance-related verification. |

| CEO | As the chief executive for the entire business, the CEO serves as the senior officer with respect to compliance and is also the supervisor for risk management, including compliance risks. |

| Compliance Officer | Along with supervising NBFM’s compliance, the Compliance Officer performs tasks related to internal auditing. |

| Risk Management & Compliance Department | Under the supervision of the Compliance Officer, this department implements compliance promotion, internal auditing, verification of risk management status, etc. |

Furthermore, with a view to preventing the emergence of compliance risks through three line-based management, NBFM has established a multi-level management system founded on the three lines of defense model, with the understanding that all officers and employees are to autonomously engage in compliance and risk management.

Policy on Anti-Corruption Initiatives

NBF and NBFM view the implementation of compliance as a key issue in the Group’s management, and in addition to establishing a compliance system, they strive to promote compliance. The Compliance Manual stipulates practical guidelines on preventing bribery, eliminating anti-social forces, preventing money laundering, ensuring fair competition, prohibiting insider trading, giving/receiving gifts and hospitality, etc., and NBF and NBFM strive to implement thorough compliance and prevention of corruption, including bribery.

Supervision by the Board of Directors

Each year, NBFM creates a Compliance Program that serves as a practical plan for implementing the Compliance Manual (the details include preventing corruption, including bribery). This program is finalized based on the approval of the Board of Directors, and the Compliance Committee receives reports about it. Verification results (achievement status, etc.) are reported to both the Board of Directors and the Compliance Committee.

If necessary, the Board of Directors and the Compliance Committee may state opinions about these reported matters, with the aim of ensuring improvement initiatives function effectively.

Gifts/Hospitality and Prohibition of Bribery

In the Compliance Manual, NBF and NBFM prohibits accepting gifts or hospitality internally or from clients or stakeholders that exceed the bounds of moderation, receiving, requesting, or promising bribes in dealings with external clients, associates, etc. (such as gifts and hospitality exceeding the bounds of moderation), and making special arrangements based on these.

Due Diligence Relating to New Clients and Brokers

For transactions with new companies and transactions with new contractors and brokers, NBF and NBFM conduct a check for anti-social activities, verify their approach to information management, and so forth as part of due diligence. Furthermore, NBF and NBFM take steps to prevent corruption in general by sharing their policies relating to corporate ethics, such as bribery and corruption.

Whistleblowing

NBF and NBFM have established an internal whistleblowing system that allows anonymous consultation, through which they strive to prevent corruption and graft of all kinds.

The company has established whistleblowing contact points for the purpose of rapidly obtaining information about risks, such as illegal conduct, improper conduct, and actions that violate compliance, and taking self-corrective action to rectify these matters. Appropriate management is implemented to strengthen protection for whistleblowers, implement investigations that lead to corrective measures, and ensure the effectiveness of the whistleblowing system.

Training

Training such as that shown below is regularly conducted for all employees and officers, including employees on temporary assignment, on a variety of topics relating to legal and other compliance (including matters relating to preventing corruption and other business ethics), through which NBF and NBFM strive to improve organizational as well as individual capabilities.

Examples of Key Initiatives

- Human rights training (September 2024 - all employees, including temporary employees)

- BCP(Emergency Response Headquarters Management Training) training (December 2024 - some employees)

- Training on customer-oriented business management (February 2025 - all employees, including temporary employees)

- Training on evidence documentation for post-implementation review (March 2025 - all employees, including temporary employees)

Information about internal rules, revisions to the law, and compliance (including matters related to preventing corruption and other business ethics) is distributed as appropriate.

Data on Fraud and Corruption

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| No. of cases of exposure related to fraud and corruption | 0 | 0 | 0 |

| No. of cases of punishment/dismissal related to fraud and corruption | 0 | 0 | 0 |

| Reconciliation cost of penalties/punishment related to fraud and corruption (yen) | 0 | 0 | 0 |

| Total amount of political donations (yen) | 0 | 0 | 0 |

Tax Transparency

NBF and NBFM make appropriate tax payments and contribute to the public good and the achievement of a sustainable society by conducting their business activities in a fair and highly transparent manner.

Compliance with Tax Laws

In accordance with the spirit of the applicable taxation, NBF and NBFM always comply with tax laws and carry out their business activities based on the intent of the law.

Ensuring Transparency

In compliance with tax laws and related laws and regulations, NBF and NBFM declare and pay their taxes in an appropriate manner. They aim to provide explanations that facilitate understanding by the tax authorities and ensure transparency. They have important tax-related issues validated by external experts, and if necessary, they also verify them with tax authorities in advance, thereby striving to minimize tax risks.

Relationship with Tax Authorities

NBF and NBFM maintain a healthy, proper relationship with the tax authorities and do not offer them any improper benefits. If a difference of opinion with the tax authorities arises, NBF and NBFM will strive to resolve it based on proactive discussion with these authorities and prevent the recurrence of problems by implementing suitable improvement measures.

Tax Planning

NBF and NBFM do not engage in so-called tax avoidance behavior, which is considered to be “reducing the tax burden in an unacceptable and inappropriate manner” by deviating from the true meaning and intent of various tax system-related provisions in ways that were not intended by the tax laws and tax agencies, even if doing so could officially be viewed as a legitimate reduction of the tax burden.

Governance Structure

The occurrence of inappropriate taxation-related incidents is a monitoring item at Risk Management Meetings, and if such a case occurs, it will be reported to NBF’s Board of Directors and NBFM’s Board of Directors.

NBF’s Taxes Paid by Country (Corporate Taxes, Etc.)

| 2024 | |

|---|---|

| Japan | 1,877,000 yen |

| Overseas | 0 yen |