Features of NBF

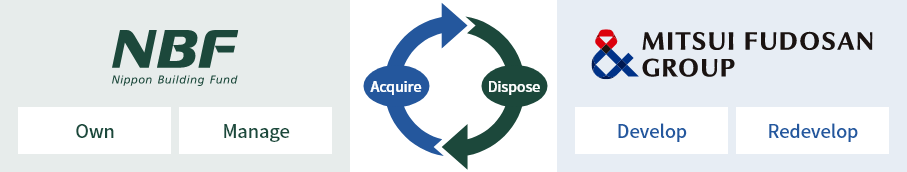

sponsored by Mitsui Fudosan

As the largest J-REIT in Japan, NBF aims to achieve steady growth of its assets and secure stable profits from a medium- to long-term perspective by maximizing the know-how of its sponsor, the Mitsui Fudosan Group.

as a J-REIT

the longest distribution record among J-REITs

Distribution per Unit

NBF implemented a split of its investment units on a five-for-one basis effective as of October 1, 2024.

NAV per Unit

NBF implemented a split of its investment units on a five-for-one basis effective as of October 1, 2024.

Total Acquisition Price

1,519.0 billion yen

Market cap

1,236.0 billion yen

Ratio of investment in central 5 wards of Tokyo(acquisition price basis)

52.6 %

Share of investment in 23 wards of Tokyo 78.1 %

Total rentable area

1.239 million ㎡

Average Occupancy Rate

98.5 %

As of Dec 31, 2025

JCR

AA+

R&I

AA

S&P

A+

LTV

43.3 %

Target 36~46%

Long-Term fixed-

rate debt ratio

83.9 %

Average

interest rate

0.67 %

Average

maturity

5.03 years

As of Dec 31, 2025

Maximum use of Mitsui Fudosan Group’s know-how

Leverage the comprehensive strengths of the Mitsui Fudosan Group

- NAV per unit = (Unitholders' capital at period end + Reserve for advanced depreciation in the next period (reserve - reversal) + Unrealized gain or loss on appraisal value at period end) ÷ Units issued and outstanding at period end